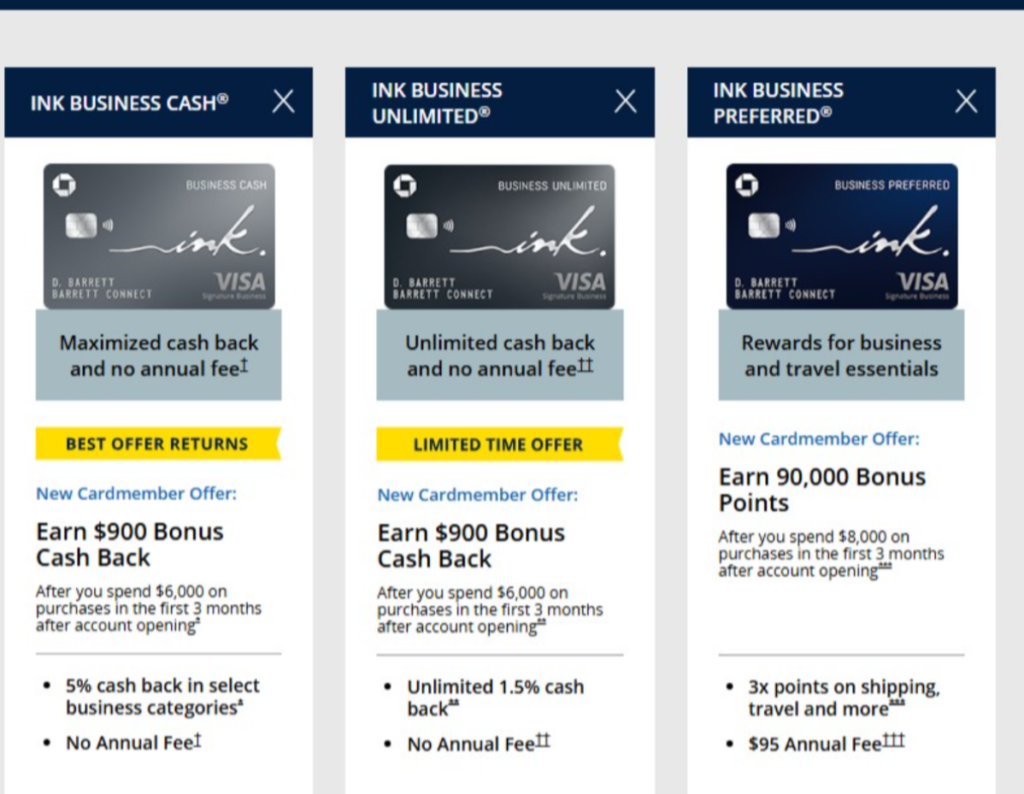

Chase just dropped two absolutely massive welcome bonuses, and I’m genuinely excited about them. We’re talking 90,000 points on not one, but TWO Chase Ink Business Cards; both with zero annual fee.

Let me say that again: 90,000 points. No annual fee. Twice.

If you’ve been waiting for the perfect moment to jump into the Chase Ultimate Rewards ecosystem or add another powerhouse card to your wallet, this is it. These elevated offers don’t come around often, and honestly, they’re some of the best no-annual-fee card bonuses I’ve ever seen.

Let me break down everything you need to know about these Chase Ink Business Cards offers, why they’re such a big deal, and how you can turn that $900 cash back into thousands of dollars in travel.

The Two Chase Ink Business Cards with 90K Point Bonuses

These no annual fee Chase Ink Business Cards offers are the best you’ll find around. No jokes!

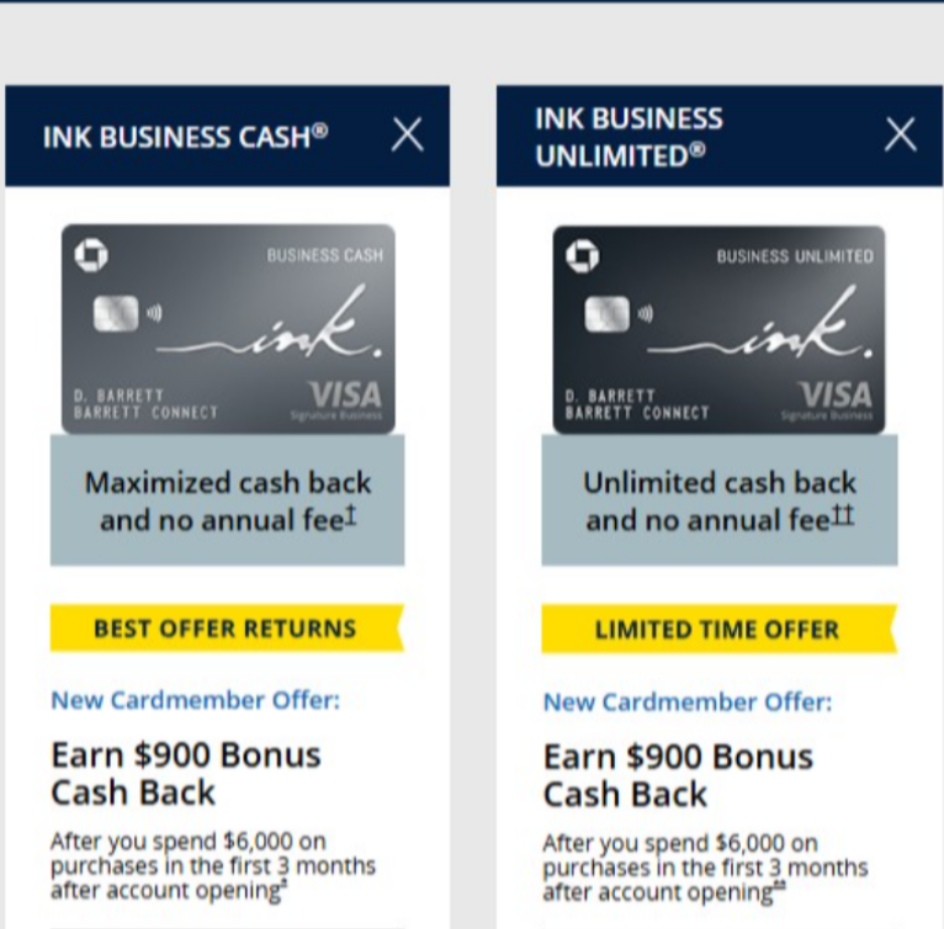

Chase Ink Business Unlimited Credit Card

Think of this as your set it and forget it card. The Ink Business Unlimited is offering 90,000 points after you spend $6,000 in the first three months.

After earning that welcome bonus, you also enjoy several advantages for everyday use:

- 1.5x points on every single purchase with no spending caps

- No categories to track or activate

- No annual fee ever

- Primary rental car coverage (rare for a no-fee card)

- Can be combined with other Chase cards for maximum flexibility

This is the Chase Ink Business Card for people who want simplicity. You don’t have to remember which category earns what or worry about hitting spending caps. Every dollar you spend earns 1.5 points, whether you’re buying office supplies, paying for advertising, or grabbing coffee.

Combine with Southwest cards to earn Companion Pass faster

Chase Ink Business Cash Credit Card

Now, if you’re willing to put in just a little bit of strategy, the Ink Business Cash can be an absolute powerhouse. You’ll still earn that same 90,000 point bonus after $6,000 spend in three months, but the ongoing earning structure is where this Chase Ink Business Card really shines:

- 5x points on office supply stores and internet, cable, and phone services (on up to $25,000 in combined purchases each anniversary year)

- 2x points on gas stations and restaurants (on up to $25,000 in combined purchases each anniversary year)

- 1x point on everything else

- No annual fee

- Primary rental car coverage

If you pay for business internet, phone bills, software subscriptions, or frequently shop at office supply stores, this card will rack up points incredibly fast. That 5x category is where the real magic happens.

Why Are These 90,000 Point Bonuses Important?

Most no-annual-fee cards offer maybe 20,000 to 40,000 points as a welcome bonus. Getting 90,000 points is exceptional, especially when you realize what these points can actually do for you.

At face value, 90,000 points equals $900 in cash back. That’s already fantastic for Chase Ink Business Card with no annual fee.

But here’s where it gets really interesting: these points become significantly more valuable when you pair an Ink card with a premium Chase card like the Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Business Preferred.

When you have one of these premium cards, you unlock the ability to transfer your Ultimate Rewards points to Chase’s travel partners at a 1:1 ratio. This is what separates these Chase Ink Business Cards from ordinary cash-back cards.

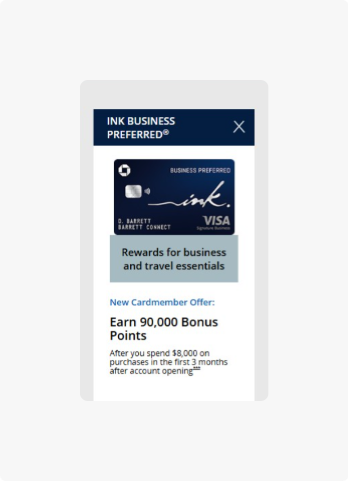

While we’ve been focusing on the two no-annual-fee Chase Ink Business Cards, there’s actually a third card worth mentioning: the Chase Ink Business Preferred Card.

This card is also currently offering 90,000 points after spending $8,000 in the first three months, but it comes with a $95 annual fee.

Chase Ink Business Preferred Credit Card

Now, if you’re willing to pay an annual fee for even better earning rates and premium benefits, the Ink Business Preferred is worth serious consideration. This card is also offering 90,000 points after you spend $8,000 in the first three months.

A few benefits that make the Ink Business Preferred special:

- 3x points on travel, shipping, internet/cable/phone services, and advertising, on the first $150,000 in combined purchases each anniversary year

- 3x points on select business categories where you spend the most each anniversary year from a list of categories like gas stations, restaurants, office supply stores, you choose)

- 1x point on everything else

- $95 annual fee only

- Primary rental car coverage

- Cell phone protection up to $600 per claim, $1,200 per year when you pay your bill with the card

- This card unlocks transfer partners for all your Ultimate Rewards points

Take note of that last point. The Ink Business Preferred is one of only three Chase business cards that allows you to transfer Ultimate Rewards points to airline and hotel partners (the others are the personal Sapphire Preferred and Sapphire Reserve cards).

If you don’t want a personal Sapphire card but still want to transfer points to partners like United, Southwest, Hyatt, and Air Canada, the Ink Business Preferred is your gateway card.

For business owners who spend heavily on travel, shipping, internet services, or advertising, the 3x earning rate can add up incredibly fast. If you spend $50,000 per year in these categories (which many businesses do), that’s 150,000 bonus points annually; worth $2,550 to $3,000 in travel value.

So why would you pay $95 when you can get the same welcome bonus with no annual fee?

- It Unlocks Transfer Partners

The Ink Business Preferred is one of the premium Chase cards that allows you to transfer Ultimate Rewards points to airline and hotel partners.

Without a premium card like the Ink Business Preferred, Sapphire Preferred, or Sapphire Reserve, your Ultimate Rewards points can only be redeemed for:

- Cash back at 1 cent per point

- Travel through Chase at 1-1.25 cents per point

- Gift cards

- Shopping at Amazon

But with the Ink Business Preferred, you unlock transfers to:

- United MileagePlus

- Southwest Rapid Rewards

- Air Canada Aeroplan

- World of Hyatt

- British Airways Avios

- Singapore Airlines KrisFlyer

- And many more

This is how you turn those 90,000 points from $900 cash back into $1,800+ in travel value.

- Superior Earning Rates on Business Spending

The Ink Business Preferred earns 3x points on:

- Travel (flights, hotels, car rentals)

- Shipping (FedEx, UPS, USPS)

- Internet, cable, and phone services

- Advertising (Google Ads, Facebook Ads, etc.)

- Plus one category where you spend the most each year (you choose from options like gas stations, restaurants, office supply stores)

These are significant business expenses for many companies. If you’re spending $3,000+ per month on these categories, the 3x earning rate will quickly offset that $95 annual fee.

Let’s say you spend just $3,167 per year in 3x categories:

- That’s 9,501 bonus points (vs earning 1x on a flat-rate card)

- Worth approximately $162 to $190 in travel value

- That more than covers the $95 annual fee

My Take: if you’re a business owner who doesn’t want a personal Sapphire card but still wants to transfer points to travel partners, the Ink Business Preferred is absolutely worth the $95 annual fee. It’s the most affordable way to unlock Chase’s transfer partners for business spending.

And if you spend heavily on travel, shipping, internet services, or advertising, the 3x earning rate makes it one of the most valuable business cards available.

I’d say to get all three Chase Ink Business Cards over time. Earn the 90K bonuses on the Unlimited and Cash cards first (no annual fees), then add the Preferred card to unlock transfers. That’s 270,000 total Ultimate Rewards points enough for incredible travel redemptions.

Also, the Ink Preferred points can be combined with Southwest cards if you’re interested in earning the Southwest Companion Pass Promotion for 2025/2026

What Can 90,000 Chase Ultimate Rewards Points Get You?

International Business Class Flights:

- Round-trip business class to South America on United Airlines: 60,000–70,000 points plus minimal taxes

- One-way business class from New York to Frankfurt on Singapore Airlines: 81,000 points plus $5.60 in fees

- Premium Economy to Asia on Singapore Airlines: 75,000 points

Luxury Hotel Stays:

- 5 nights at a Hyatt all-inclusive resort in Mexico (typically worth $2,500+)

- 4+ nights at the Park Hyatt Chicago (21,000 points per night)

- Multiple nights at high-end Hyatt properties worldwide

Domestic Travel:

- Multiple round-trip flights for a family within the U.S. or to the Caribbean

- Short-haul United flights for as low as 8,800 miles each way

This is why I value Ultimate Rewards points at around 1.7 to 2 cents per point when you’re strategic about redeeming them. That makes a 90,000-point bonus worth $1,530 to $1,800 in travel value; not bad for spending $6,000 on a card with no annual fee!

Who Should Get These Chase Ink Business Cards?

You Should Get the Ink Business Unlimited If:

- You want the simplest possible earning structure

- You don’t want to think about bonus categories

- Your business spending is spread across many different categories

- You want a solid everyday earner with no annual fee

- You’re just starting to build your Chase Ultimate Rewards portfolio

You Should Get the Ink Business Cash If:

- You pay for internet, phone, or cable services for your business

- You spend regularly at office supply stores

- You frequently fill up at gas stations or dine out for business

- You’re willing to track spending in bonus categories (though the $25,000 annual cap is very generous)

- You want to maximize earnings in specific categories

You Should Get the Ink Business Preferred If:

- You want to unlock Chase transfer partners without getting a personal Sapphire card

- You spend heavily on travel, shipping, internet/cable/phone services, or advertising

- You’re willing to pay a $95 annual fee for premium earning rates and benefits

- You want 3x points on significant business expense categories on the first $150,000 per year

- You need cell phone protection for your business phones

- You want the highest earning rates on common business spending

- You’re building a serious Chase Ultimate Rewards strategy and need a card that unlocks transfers

Note that: the Ink Business Preferred is the only one of these three Chase Ink Business Cards that allows you to transfer points to airline and hotel partners. Without it (or a Sapphire card), you can only redeem points for cash back or book travel through Chase’s portal. With it, you unlock the full value of Ultimate Rewards points through transfers to partners like United, Southwest, Hyatt, and more.

Here’s the Secret: You Can Get BOTH Chase Ink Business Cards

This is one of my favorite Chase strategies. Unlike some card issuers that limit you to one card per product line, you can hold multiple Chase Ink Business Cards at the same time.

That means you could apply for the Ink Business Unlimited, Ink Business Cash, AND Ink Business Preferred and earn up to 270,000 total Ultimate Rewards points from the welcome bonuses alone.

The strategy:

- Apply for your first card (I’d suggest starting with the no-fee cards)

- Wait 30 to 45 days after approval

- Apply for your second card

- Wait another 30 to 45 days

- Apply for the third card

This gives you:

- 90,000 points from Ink Business Unlimited

- 90,000 points from Ink Business Cash

- 90,000 points from Ink Business Preferred

- Total: 270,000 Ultimate Rewards points (worth $4,590 to $5,400 in travel value)

Even better? If you have multiple businesses (even a side hustle qualifies), you can potentially get approved for the same card multiple times for different business entities.

Do You Need a Real Business to Apply for Chase Ink Business Cards?

This is the question I get asked most often, and the answer might surprise you: No, you don’t need an established corporation or LLC.

Chase approves Ink Business cards for:

- Sole proprietors

- Freelancers

- Side hustlers

- Anyone with any form of business income (even part-time)

Do you sell items on eBay, Etsy, or Facebook Marketplace? That’s a business. Do you freelance, consult, or do gig work? That’s a business. Do you rent out a room on Airbnb or have a hobby that generates any income? That’s a business.

You can apply using your Social Security Number instead of an EIN (Employer Identification Number), and you can list your business as a sole proprietorship with your name as the business name.

I personally got approved for my first Ink card when I had a very small side business, and many of my readers have had similar success.

Important Eligibility Requirements to Know

Before you apply, keep these in mind:

Chase’s 5/24 Rule: Chase may not approve you if you’ve opened five or more personal credit cards (from any bank) in the past 24 months. This is informally called the 5/24 rule. However, there are increasing reports that Chase isn’t enforcing this as strictly as they used to, especially for business cards.

24-Month Bonus Rule: You can’t earn a welcome bonus on a specific Chase card if you’ve received a bonus on that same card in the past 24 months. However, this is card-specific: if you got a bonus on the Ink Business Cash, you can still earn a bonus on the Ink Business Unlimited.

One Chase Business Card Every 30 Days: It’s generally recommended not to apply for more than one Chase Ink Business Cards within 30 days. If you want both cards, space out your applications.

No Relationship to Other Chase Cards: The great news is that getting a bonus on any of the Chase Ink Business Cards doesn’t affect your eligibility for bonuses on other Chase cards, including the Sapphire cards or Southwest cards.

How to Maximize These Chase Ink Business Cards

Step 1: Apply for One (or Both) Chase Ink Business Cards. Start with the card that best fits your spending patterns. If you’re going for both, apply for one first, wait for approval, then apply for the second about 30 to 45 days later.

Step 2: Meet the Minimum Spend Requirements. You need to spend $6,000 in three months on each card. That’s $2,000 per month, which most businesses can easily hit with normal expenses. Don’t overspend just to hit the bonus, only put on the card what you’d normally spend anyway.

Step 3: Get a Premium Chase Card to unlock the full transfer potential of your Ultimate Rewards points, you’ll need one of these cards:

- Chase Sapphire Preferred ($95 annual fee)

- Chase Sapphire Reserve ($550 annual fee)

- Chase Ink Business Preferred ($95 annual fee)

These cards allow you to transfer points to airlines and hotels, where you’ll get 1.7 to 2+ cents per point in value.

Step 4: Pool Your Points. All your Chase Ultimate Rewards points from your Ink cards automatically pool together with points from your premium Chase card. This means you can combine points from multiple cards for bigger redemptions.

Step 5: Transfer to Partners or Book Through Chase Travel. Depending on your travel plans, either transfer points to partners like United, Southwest, Hyatt, or Air Canada for maximum value, or book through the Chase Travel portal at 1.25 cents per point (with Sapphire Preferred) or 1.5 cents per point (with Sapphire Reserve).

My Take: These Are Some of the Best No Fee Chase Ink Business Cards Offers Ever

I’ve been tracking credit card offers for years, and these 90,000 point bonuses on no annual fee cards are exceptional. Let me put this in perspective:

Most no-fee cash-back cards offer maybe 20,000 to 40,000 points (worth $200-$400) as a welcome bonus. These Chase Ink Business Cards are offering more than double that.

Even premium cards with $95 or higher annual fees rarely offer 90,000-point bonuses. When they do, you’re usually looking at a much higher minimum spend requirement than $6,000.

The combination of:

- Massive 90,000 point welcome bonus

- No annual fee

- Solid ongoing earning rates

- Ability to transfer points to travel partners

- Primary rental car coverage

…makes these Chase Ink Business Cards absolute no-brainers if you have any business income whatsoever. These points can also help you reach Companion Pass faster when combined with Southwest cards.

When Does This Chase Ink Business Cards Offer End?

Chase hasn’t announced an official end date for these elevated offers. They could last for months, or they could end next week. In my experience, the best offers tend to disappear without much warning.

If you’ve been on the fence about applying for a Chase Ink Business Cards, I wouldn’t wait. These 90,000-point bonuses are legitimately some of the best we’ve seen on these cards, and there’s no guarantee they’ll come back once they’re gone.

Chase Ink Business Cards FAQs

Can I get both the Ink Business Unlimited and Ink Business Cash cards? Absolutely! You can hold multiple Chase Ink Business Cards simultaneously. Many people get both cards to maximize their welcome bonuses (180,000 total points) and take advantage of both earning structures.

Do I really need a business to apply for these cards? You need some form of business income, but it doesn’t have to be a registered LLC or corporation. Sole proprietorships, freelance work, side hustles, and even hobby income all qualify. If you have any business-related income at all; even part-time, you can apply.

What if I’ve never had a business credit card before? That’s totally fine! Many people get approved for their first business card from Chase even without an established business credit history. Chase will primarily look at your personal credit score and history when making approval decisions.

Can I use my Social Security Number instead of an EIN? Yes. When applying as a sole proprietor, you can use your Social Security Number in place of an Employer Identification Number. This is how most people with small businesses or side hustles apply.

How do I transfer Ultimate Rewards points to airline and hotel partners? You need to have one of Chase’s premium cards (Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred) to unlock transfer partners. Once you have one of these cards, you can transfer points from your Ink Business Unlimited or Ink Business Cash directly to partners like United, Southwest, Hyatt, and more through the Chase Ultimate Rewards portal.

What’s the difference between the Ink Business Unlimited and the Ink Business Cash? The Ink Business Unlimited earns a flat 1.5x points on all purchases with no caps, perfect for simplicity. The Ink Business Cash earns 5x on office supplies and internet/phone/cable services (up to $25k per year) and 2x on gas and restaurants (up to $25k per year) better if your spending aligns with these categories. Both have the same 90,000-point welcome bonus and no annual fee.

How does Chase’s 5/24 rule affect these applications? Chase’s informal 5/24 rule means you may not get approved if you’ve opened five or more personal credit cards (from any bank) in the past 24 months. However, there’s increasing evidence that Chase isn’t enforcing this rule as strictly on business cards. Business cards also typically don’t count toward your 5/24 status (though Chase personal cards do).

Can I earn multiple 90,000-point bonuses if I have multiple businesses? Yes! If you legitimately have multiple business entities (for example, one LLC and one sole proprietorship), you can apply for the same Ink card for each business and earn the welcome bonus on each card.

Are these points worth more than the $900 cash back? Potentially much more! When you have a premium Chase card that allows transfers to airline and hotel partners, these points are typically worth 1.7 to 2+ cents each, making 90,000 points worth $1,530 to $1,800+ in travel value. That’s nearly double the cash-back value.

What’s the difference between the Ink Business cards and the Sapphire cards? The Ink cards are business cards with no annual fee, while Sapphire cards are personal cards with annual fees ($95 for Preferred, $550 for Reserve). However, Sapphire cards unlock the ability to transfer points to travel partners. Many people pair any Chase Ink Business Cards with a Sapphire card to maximize both welcome bonuses and transfer flexibility.

Does getting an Ink card affect my ability to get a Sapphire or Southwest card later? No! The eligibility for Ink card bonuses is completely separate from other Chase card bonuses. You can get bonuses on Ink cards, Sapphire cards, and Southwest cards as long as you meet each card’s individual eligibility requirements.

How long do I have to meet the $6,000 minimum spend? You have three months from account opening to spend $6,000 on purchases to earn the 90,000-point bonus. That works out to $2,000 per month, which is manageable for most businesses through normal operating expenses.

Will applying for Chase Ink Business Cards hurt my personal credit? Chase will check your personal credit when you apply for a business card, which may result in a hard inquiry on your personal credit report. However, the account itself typically won’t appear on your personal credit report (unless you miss payments), so it won’t affect your personal credit utilization.

Bottom Line

Chase Ink Business Cards current 90,000 point offers on both the Ink Business Unlimited and Ink Business Cash cards are absolutely phenomenal, especially for cards with no annual fee.

Whether you go with the simplicity of the Unlimited (1.5x on everything) or the category bonus power of the Cash card (5x on office supplies and internet/phone/cable), you’re looking at minimum $900 cash back or up to $1,800+ in travel value when you strategically use transfer partners.

If you have any form of business income; and I mean any, even a small side hustle, these cards are worth serious consideration. The combination of massive welcome bonuses, solid ongoing earning rates, valuable benefits like primary rental car coverage, and the flexibility of the Chase Ultimate Rewards ecosystem makes them some of the best business cards available.

Don’t sleep on these offers. Elevated bonuses like this don’t last forever, and 90,000 points on a no annual fee Chase Ink Business Card is genuinely rare. Whether you’re building your Chase strategy from scratch or adding to an existing portfolio, now is the time to act.

Ready to earn 90,000 Ultimate Rewards points with no annual fee? The clock is ticking on these incredible Chase Ink offers!

3 Comments